Demianchuk L.V.,

Scientific adviser: Ivanchuk N. V.

National University of Ostroh Academy

The article states that cash flows from operating, investing and financing activities are one of the key characteristics for any company or business. The author determines the model of multi-objective optimization of cash flows in PJSC “Rivneazot” and provides recommendation for maximization of its net cash flows.

Key words: cash flows from operating, investing and financing activities, net cash flows, revenue, costs, solvency.

Formulation of the problem. Nowadays scientists state that the functioning of an enterprise is a complex and dynamic process that is the result of continuous and cyclical cash flows. Therefore, the analysis of cash flows is an essential aspect that makes it possible to objectively assess the financial position of any entity, since imbalance of cash inflows and cash outflows can lead to insolvency of business.

Analysis of recent research and publications. The theoretical and practical aspects of the chosen subject have been done by domestic and foreign scientists such as M. P. Voinarenko, L. S. Kriuchko, N. I. Kolomiets, T. V. Pepa, V. O. Podolska, O. O. Tereshchenko, S. M. Semenova, N. P. Shmorgun and many others. However, despite significant scientific achievements of scholars, the issues of improvement of cash flows in companies remain open.

The purpose and objectives of the study are to examine cash flows in PJSC “Rivneazot” and to identify the key areas of its improvement.

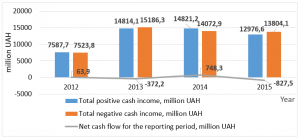

An account of the main material. The PJSC “Rivneazot” is a leader among manufacturers of fertilizers in Western Ukraine, but nowadays the company has experienced some financial difficulties and is in a state of financial crisis. So, the first step is the assessment of dynamics of cash flows in the selected entity (Fig. 1). Figure 1 illustrates that during the study period there were constant changes in the value of net cash flow due to the changes in the proportions between positive and negative cash flows.

In particular, in 2012, a positive net cash flow is observed, which amounted to 63.9 million UAH, which has been entirely achieved through incomes from operating activities. This indicates a priority of this type of cash flow for the enterprise. In 2013 negative net cash flow was obtained in the amount of 372 million UAH, which was due to the fact that the negative cash flow from operating activities predominated over the positive.

Fig.1. Cash flows in the Rivneazot JSC during 2012-2015

*Source: calculated by the author on the basis of source [1-2].

According to the results of 2014, there is a positive value of the analyzed indicator, which amounted to 748 million UAH by reducing the sum of negative cash flow from operating activities. However, in 2015, the negative net cash flow was again achieved in the amount of 827 million UAH (maximum value).

However, the analysis of the sufficiency of cash resources only based on the cash flow statement doesn’t allow to estimate the actual solvency of this enterprise. Therefore, the key tasks are the analysis of the effectiveness of cash using and an assess of the liquidity and solvency of PJSC “Rivneazot” on the basis of system of relative indicators (Table 1).

Table 1

Dynamics of relative indicators of assessment of the cash flows in PJSC “Rivneazot”

| Indicators |

Years |

|||

| 2012 | 2013 | 2014 | 2015 | |

| Cash flow efficiency ratio | 0,008 | -0,025 | 18,805 | -16,683 |

| Operating Cash Flow/Sales Ratio | 0,071 | -0,258 | 0,531 | -0,153 |

| Operating-cash-flow-to-total-assets ratio | 0,036 | -0,066 | 0,180 | -0,076 |

| The liquidity ratio of cash flow | 1,008 | 0,975 | 1,053 | 0,940 |

| Cash cover ratio of current liabilities | 0,033 | -0,055 | 0,094 | -0,023 |

| The level of net cash inflows | -0,071 | 0,429 | -0,065 | 0,076 |

*Source: calculated by the author on the basis of source [1-2].

The analysis of the efficiency of the use of cash shows that the company has got a low effectiveness of the cash flow. In particular, the best values are observed in 2014, since the company generated 0.19 UAH of the net cash flow per 1 UAH negative cash flow, and 0.18 UAH per 1 UAH of its assets. As for the next analyzed period, it is obvious that the situation has worsened following the results of 2015. Considering the fact that the value was less than one, it indicates the insolvency of the analyzed company.

Another important characteristic is the cash cover ratio of current liabilities by the net cash flow from operating activities. Whereas the significant amount of current liabilities of the company usually appears in a process of its operating activities. The value of this index in 2015 is negative, which confirms the short-term insolvency of PJSC “Rivneazot”. Also, its financial instability could be assumed, because an indicator of the level of the net cash income is much less than the normative value.

Thus, there research shows that PJSC “Rivneazot” requires the management system that could restore the cycles of operating, investing and financing activities of the enterprise, and provide the balance of their cash flows in order to improve and optimize its liquidity and solvency.

Nowadays, cash flow optimization models based on maximizing net cash flow of the enterprise as a whole are playing the leading role in the economic literature. However, the operating activity, which is the main activity of the enterprise, has to be the key factor in the growth of net cash flow. In other words, it is needed to achieve the dominance of cash inflow from sales over the cash outflow provided by operating activities. As a result, it will help to finance their investment needs and reduce the amount of borrowings.

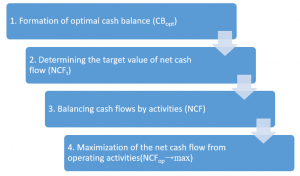

So, based on the analysis of cash flows and comprehensive assessment of the selected entity, the model of multi-objective optimization of cash flows of PJSC “Rivneazot” can be represented (Fig. 2).

As a result, the final criterion is the maximization of the net cash flow from its operating activities. That will be achieved through the following two conditions:

- the growth of the positive (incoming) operating cash flow and a domination of incoming cash flows over the outgoing ones;

- the increase of the efficiency of operating cash flow, because this figure acquired a negative value in 2015[4].

Figure 2. The model of multi-objective optimization of cash flows of PJSC “Rivneazot”

*Source: [4].

Thus, the initial step is to determine the optimal balance of funds (assets) of the enterprise on the basis of the most prominent foreign models of cash management, such as Baumol model, Miller-Orr model, and the Poddierohin’s model. Since each of the proposed methods has certain advantages and disadvantages, so all of the abovementioned models were applied (Table 2).

Analyzing data in the table, it is obvious that the results of calculating the optimal cash balance according to classical models vary greatly. Thus, Baumol model shows that the amount of available funds should be equal to 9 288.45 thousand UAH. However, it is considered that it is not the appropriate value for this company, since in this case the level of absolute solvency will be 0.0003, which is unacceptable.

According to Miller-Orr model, the cash balance must be equal to 6611 million UAH, which is more acceptable and adapted. Regardless of the fact, that the specified value fits the condition of absolute solvency, this amount is 73.21% of the total assets of PJSC “Rivneazot”. Hence, it is impossible to use the abovementioned value like an optimal value to provide realistic projections.

Table 1.2

Determining the optimal cash balance in PJSC “Rivneazot” in 2015

| Models | Results | Data-out |

| Baumol model | 9 288,45 thousand UAH |

Outgoing cash flow – 13 804 0505 thousand UAH; The average interest rate on short-term financial investments – 7% (in foreign currency); The costs of conversion of funds in securities – 1 thousand UAH (hypothetical assumption). |

| Miller-Orr model | 6 611 797,20 thousand UAH |

The variation of the incoming cash flow – 7,233,503 thousand UAH (Max value – 14,821,203 thousand UAH in 2014 and min value – 7,587,700 thousand UAH in 2012); The minimum total of money (insurance balance) – 6611 120.4 thousand UAH (calculated on the basis of norm of its solvency). |

| Poddierohin’s model | 3 738 663,19 thousand UAH |

Cost of sales – 2,546,991 thousand UAH; The amount of accumulated depreciation in 2015 – 253 695 thousand UAH; Turnover ratio of current assets – 0.6134. |

*Source: calculated by the author on the basis of source [2-3].

Therefore, the result of Poddierohina model is the most optimal and balanced amount, and it can be accepted as a basis for further calculations.

The next step is to determine the target value of net cash flow (NCFt). Calculations show that it should be 2896 315.19 thousand UAH. This value could be able to ensure continuity of the operation of the entity and improve its liquidity and solvency. Consequently, it would lead to a gradual stabilization of the financial situation of the company.

The achievement of the calculated value of net cash flow value will be gained through balancing cash flows from financing and investment activities and maximizing net cash flow from operating activities in PJSC “Rivneazot”.

In particular, the maximization of net cash flow from operating activities can be achieved by the predominance of income over expenditure. To sum up, PJSC “Rivneazot” can implement the following measures:

1) the statement of cash flows from main types of activities should be set on a monthly basis;

2) the development of statements of cash flows from operating activities in the geographical context, as since 2015 PJSC “Rivneazot” has exported their products to the new market (UAE);

3) the investment in the development and improvement of the most profitable products, in our case – ammonium nitrate, because the selling of said goods generates the bulk of revenues from operating activities;

4) carrying out the systematic analysis of all incoming and outgoing cash flows from operating activities [5];

5) the optimization of accounts receivable for products, goods, works and services that will lead to the increase of its cash assets.

In particular, the implementation of the last mentioned measure is the key because the accounts receivable for products, goods, works and services amounted to 18.87% of total assets in 2015. This indicates the significant diversion of current assets, which leads to deceleration of its operating cycle.

Conclusions. Thus, the proposed methodology of optimizing cash flows in PJSC “Rivneazot» involves the process of balancing cash flows from financing and investing activities, and maximizing net cash flow from operating activities. This approach to the concept of planning and cash management activities will lead to focusing on achieving the financial stability and solvency.

Literature

1. Finance.UA [Електронний ресурс]:[Інтернет-портал]. – Електронні дані. – [Київ: Український Інтернет холдинг ТОВ “Файненс.ЮА”, 2000-2017]. – Режим доступа: http://finance.ua/ua/.

2. Офіційний сайт ПАТ «Рівнеазот» [Електронний ресурс] / Режим доступу: http://www.azot.rv.ua/.

3. Крючко Л. С. Вдосконалення напрямів управління грошовими потоками підприємств / Л. С. Крючко. // Вісник Дніпропетровського державного аграрного університету. – 2013. – № 2 (32). – С. 198–200.

4. Семенова С. М. Управління грошовими потоками на підприємствах водного транспорту: обліково-аналітичний аспект [монографія] / C. М. Семенова, О. М. Шпирко. – Київ: Центр учбової літератури, 2016. – 252 с.

5. Карпенко Л. М. Методи оптимізації та моделі управління грошовими потоками на підприємстві / Л. М. Карпенко // Вісник соціально-економічних досліджень. – 2014. – Вип. 1. – С. 201-210. – Режим доступу: http://nbuv.gov.ua/UJRN/Vsed