Ivanna Kuidan

student of the economic department, Department of Economic

and Mathematical Modeling and Information Technologies

Adviser

PhD in Economics, assoc. Novoseletskyy O. M.

The National University of Ostroh Academy

Abstract. The article analyzes the main methods of risk analysis of insurance companies and reflects peculiarities of using a scenario-based method for assessing the risks of insurers’ functioning. Also, the article assesses the main risks that the insurer must pay attention to when making appropriate decisions. In addition, the article constructs a scenario-based assessment of the insurance risks of an average insurance organization.

Keywords: insurance company, scenario, scenario-based assessment.

Анотація. У статті проаналізовано основні методи аналізу ризиків страхових компаній, відображені особливості використання сценарного методу оцінювання ризиків функціонування страховиків, проведена оцінка основних ризиків на які звертає увагу страхувальник при прийнятті відповідних рішень, та побудовано сценарну оцінку страхових ризиків середньостатистичної страхової організації.

Ключові слова: страхова компанія, сценарій, сценарна оцінка.

Problem formulation. In terms of development of the global economic system, the problem of perfect development of the insurance sector acutely raises. The stable functioning of this sector is an important indicator of the state of the economy. Risks associated with the insurers’ activities affect the development and functioning of the insurance market in general. The study of the scenario-based assessment of insurance risks will allow to improve the insurer’s risk management system, which, in the current circumstances, is one of the most topical issues of the Ukrainian insurance market.

Analysis of the recent research papers and publications. The problem of improving the insurance system of insurance companies has been considered by researchers for a long time. Significant development of the methodology for managing economic and financial risks was made by V. V. Vitlinskyi [1]. K. V. Voitovych [2], who researched the use of the scenario-based approach to the process of adjusting the values of the insurance marketing system elements in risk conditions, made an important contribution to the study of the insurance organizations’ risks. Various aspects of the scenario-based risk assessment are presented in the works of K. I. Tarasova, H. V. Solodovnyk, O. O. Shevchuk, M. I. Hulyk.

The purpose of the study is to identify the main methods of risk analysis of an insurance organization and build a scenario-based assessment of insurance risks.

The main material. Under conditions of uncertainty, versatility of trends in the insurance market and sufficiently long periods of planning the activities of an insurance company, the scenario-based method of risk analysis significantly improves the effectiveness of estimating the possible losses of an insurer. As a result, this can be instrumental in making managerial decisions in the process of conducting business. Therefore, one of the main factors of the insurer’s successful activity is to do an effective scenario-based risk assessment, which will provide qualitative and complete modeling of options for developing an insurance company.

In world practice of insurance management, many methods of insurance risks analysis are used. Table 1 presents the comparative characteristics of the methods, most frequently used in practice in Ukrainian and foreign insurance companies, with an indication of their advantages and disadvantages.

Table 1

Comparative characteristics of methods of risks analysis of an insurance organization

| Method | Advantages | Disadvantages |

| Sensitivity analysis |

· possibility of estimating the influence of a certain factor on the final result; · simplicity of calculations. |

· a change of each factor is considered in isolation, whereas in fact, the factors are correlated in varying degrees. |

| Decision tree |

· analysis of different variants of events development; · well applied in the situations when the decisions made depend on the decisions taken earlier. |

· limitation of the number of development options; · difficulty in determining probabilities. |

| Scenario method | · possibility of taking into account the influence of a set of factors. | · possibility of a high level of subjectivity |

| Monte-Carlo method |

· possibility of taking into account various variants of development of events; · combination with other economic and statistical methods. |

· implementation complexity since it is necessary to determine the distribution law and apply special software. |

Source [created by an author]

Taking into consideration the advantages and disadvantages of insurers’ risk assessment methods, the scenario-based analysis involves identification of several possible variants (scenarios) of assessment and comparison of insurance risks as well as reflects the optimal scenario of an insurer’s development in the most comprehensible way. The main task of the scenario-based assessment is to analyze the main risks of an insurance organization, which will allow its leaders to collaborate so as to achieve the main strategic goals of the organization.

To implement the scenario-based method for assessing the risks of the operation of insurance companies, the specific steps are recommended to follow:

- Selection of objects and key elements of research.

- Establishment of conditions and prospects for the existence of an insurance company.

- Study of the predictable uncertainty zones in terms of factors and their degree of influence. Determination of the realization probability of the given factors and sets of factors.

- Selection of the scenario structure as a combination of predicted estimates of the change of individual factors and their mutual influence.

- Determination of the principles of formation of individual variants of scenarios: the probability of implementing certain sets of factors (gradation of probability estimates); according to the degree of influence on the object of the scenario-based research – from optimistic to pessimistic variant.

- Formation of final scenarios. The most probable scenario option is selected as the main one, on the basis of which a detailed action plan for the scenario-based study object is developed [2, p. 39].

For the scenario-based assessment, an average insurance company, which operates in the modern Ukrainian insurance market and has a classic insurance portfolio, will be considered. The classic insurance portfolio consists of a set of traditional insurance services, which has been the basis of insurance in Ukraine for a long period. As a rule, it includes contracts of compulsory and voluntary insurance in personal and property insurance, while the list of insurance services provided is traditional:

- in the field of personal insurance – it is insurance against accidents and illnesses, voluntary health insurance of employees of enterprises and organizations, pension insurance, life insurance of individuals;

- in the field of property insurance – insurance of vehicles, belonging to citizens, insurance of homeownership, buildings, insurance of property, belonging to organizations and enterprises of various forms of ownership.

Typically, a traditional classic portfolio is the most sustainable in terms of finances and risk level and refers to a conservative type. The insurer’s return on the classical type of insurance portfolio is stable and not high at moderate risk.

Nowadays the classical type of insurance portfolio is used by such Ukrainian insurance companies as Ingosstrakh, Oranta, Ingo Ukraine, Providna, Insurance group TAS, Arsenal insurance and others. Thus, a scenario-based approach will be used to assess the insurance risks of such insurance companies.

To assess the main risks of an insurance organization, the main strategies of its activity will be identified. This will allow to conduct research in accordance with the ultimate goal of the investor. Among the main strategies, the following are distinguished:

- profit maximization;

- achievement of the largest share in the market of insurance services;

- realization of stable activity.

When determining strategies, consideration should be given to possible scenarios of assessing and managing the risks of an insurance organization. Three main options are distinguished:

1) Scenario №1. The basis of the insurance company’s activity is a method of maximizing organization’s profits. In this case, the main efforts of the company’s managers should be focused on maximizing the return on investment. It is not always possible to do in another way as the insurer may be subject to restrictions related to the social role of insurance. Thus, the receipt of high profits by the insurer becomes, in some cases, an auxiliary task that ensures the fulfillment of a basic social function.

2) Scenario №2. The basis of the activity of an insurance organization is a goal of achieving the largest share in the insurance market. In this case, it is worth using such options as developing new insurance products and putting them on the market, or dumping prices, in other words, artificially lowering prices for insurance services. Using these options, it is necessary to pay close attention to the management of insurance reserves, particularly their level of liquidity.

3) Scenario №3. This scenario is based on the managers’ willingness to achieve the stable activity of the legal entity. This can be done through the use of such methods as diversification of the insurance portfolio in order to reduce the overall degree of portfolio risk; reinsurance, which also redistributes risk and other similar methods, which, in fact, minimize the risk of losses by insurance companies, thus providing sustainable financial activity.

Possible options for assessing the risks of an insurance organization in accordance with the scenarios are listed in table 2.

Table 2

Possible options for assessing the risks of an insurance company

| Risk of an insurance company | Variants of risk values of an insurance company | Average score of the 1st value option | Average score of the 2nd value option | Average score of the 3rd value option |

| Technical risk | Risk of tariff lack | 3 | 1 | 2 |

| Risk of insufficiency of insurance reserves | 2 | 1 | 3 | |

| Reinsurance risk | 2 | 1 | 3 | |

| Risk of operational losses | 2 | 1 | 3 | |

| Risk of significant losses | 3 | 1 | 2 | |

| Catastrophic risk and cumulative risk | 2 | 1 | 3 | |

| Risk of growth | 1 | 3 | 2 | |

| Liquidation risk | 2 | 1 | 3 | |

| Investment risk | Asset impairment risk | 3 | 1 | 2 |

| Risk of insufficient asset liquidation | 2 | 1 | 3 | |

| Risk of liability mismatch | 2 | 1 | 3 | |

| Interest rate risk | 2 | 1 | 3 | |

| Investment appraisal risk | 2 | 1 | 3 | |

| Risk of investing in other companies | 2 | 3 | 1 | |

| Risk, associated with the use of securities | 2 | 3 | 1 | |

| Non-technical risk | Risk management | 1 | 2 | 3 |

| Risk, related to the performance of obligations to the third parties | 1 | 3 | 2 | |

| Risk of lack of funds from the third parties | 2 | 3 | 1 | |

| Total business risk | 2 | 1 | 3 |

Source [created by the author]

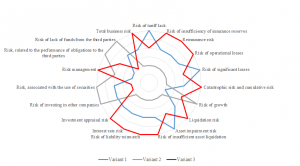

Estimates of the risk values of the insurance company in accordance with the strategies set are shown in Table 2. Thus, the effect of risk on the activity of the insurance organization will be determined by an average assessment of each option (the least impact on the chosen strategy will be assessed at 1 point, and the highest — at 3 points). These insurers’ risk assessments are reflected in the petal diagram (Fig. 1). According to the input data, the best scenario will be the one, which covers the largest area, that is the third scenario.

Fig.1 Comparison of insurance risk assessment scenarios

Finally, to calculate the required scenario, the calculation of its joint estimate is used. The above mentioned scenarios have the following joint estimates:

- scenario №1 — 38 points;

- scenario №2 — 30 points;

- scenario №3 — 43 points.

Conclusions. Thus, the best scenario for assessing insurance risks is the third option, based on the managers’ willingness to achieve the stable activity of the legal entity. The considered approach is not objective enough, but it allows the managers of insurance organizations to organize the work in the company, properly assess, optimize and avoid the risks, associated with the insurer’s professional activities.

LITERATURE

- Vitlinskyi V. V. (2003). Conceptual foundations of risk management in the financial activities. Ukrainian Finances, 3, 3-7. Kyiv: Ukrainian Press.

- Voitovych K. K. (2011). Use of a scenario-based approach to the adjustment of the values of the elements of the system of insurance marketing in times of crisis. Investments: Practice and Experience, 13, 38-44.

- Solodovnyk H. V. (2015). Qualitative and quantitative risk analysis in the sphere of insurance business. Young Scientist, 4(19), 55-57.

- Dribnokhod A. O. (n.d.) Approach to the selection of insurance portfolio in accordance with the insurer’s aims. Retrieved from: http://vlp.com.ua/files/10_28.pdf

- Shevchuk O. O. (2016). Methods of risk assessment in the insurance business. Academic Reporter of Ukrainian National Forestry University, 26(2), 291-299.

- Yermoshenko A. M. (2009). Scenario-based analysis as a means of combatting risks of cooperation between insurers and commercial banks. Topical Problems in Economics, 10(100), 88-96.