Sofilkanych O. I.

student group E-44 at the Department of Finance and Accounting of the National University of Ostroh Academy

Kharchuk J.

PhD in economics, senior lecturer at the Department of Finance and Accounting

THE MOTIVATION OF EMPLOYEES BY EQUITY INSTRUMENTS: FEATURES EVALUATION AND REFLECTION IN ACCOUNTING

У статті досліджено існуючі програми мотивації працівників підприємства на основі акцій, що використовуються в міжнародній практиці. Розглянуто ключові проблемні питання стосовно відображення в обліку стимулювання робітників інструментами власного капіталу.

Ключові слова:інструменти власного капіталу, стимулювання на основі акцій, опціонні програми, облік опціонних програм.

В статье исследованы существующие программы мотивирования роботников на основе акций, которые используются в международной практике. Рассмотрены ключовые проблемные аспекты отражения в учете стимулирования роботников инструментами собственного капитала.

Ключевые слова: инструменты собственного капитала, стимулирование на основе акций, опционные программы, учёт опционных программ.

The article deals with the investigation of existing programs based on shares that motivate workers and are used in international practice. The key problematic aspects are considered regarding the recording of stimulation among workers by the equity capital instruments.

Keywords: instruments equity, incentive share-based option programs, accounting option programs.

Formulation of the problem. In the face of rapid development of the economy and the reconstruction of the market after the global financial crisis it is particularly important in the functioning of enterprises and organizations, to encourage top managers. Efficient, adequate and effective system of incentives for management personnel is the key to increasing productivity and competitiveness of enterprises. The system of motivating employees includes both cash compensation, vacation, improving working conditions as well as payments on the basis of equity instruments. The latter method of long-term motivating of top-managers gained significant development in the world practice. On the one hand, direct financial interest of employees in improving the performance of an enterprise is an important motivational lever. On the other, the use of equity instruments (hereinafter – EI) with the aim of motivating managerial staff ensures the diversification of ownership structure, increases the effectiveness of the activities of the entity, contributes to maintaining its stability of the position of the company on the stock market and the growth of capitalization. Therefore, the specified above factors determine the relevance of the research on types of motivation, the conditions of their application, the features of the evaluation and reflection in accounting.

Analysis of recent research and publications. A study of the motivation of the top management for share-based has been reflected in the works of O. O. Loginova [3], who examines the international experience of stimulation programs, and analyzes the experience of Russia in this aspect. The issue of calculation for share-based pay attention is developed by a scientist such as O. Bracilo. In his works he attracs accounting calculation tools of equity, reflected in the statements of conditional and unconditional rights to obtain EI and the impact of the reporting option programs [4].

P.Grachova explores the calculations involving equity instruments in accordance with international standards, analyses the operation on the basis of equity, pays attention to the definition of the value of the stock options [6]. Also P. Grachova determined the essence of these terms, investigated the difference between call and put options, and paid special attention to display in accounting operations with options and warrants [7].

The aim of the study is to generalize the existing approaches to the implementation of programs of motivation of employees by equity instruments, as well as examine the accounting aspects of this issue.

Data analysis the results. The implementation of the programs to motivate managers by EI has significant advantages for both the employees and the company. Since beginning such programs have been beneficial in connection with a financial interest in long-term and sustainable development of the business due to the dependence relation income of Managers on to the share price of the company. For the enterprise management, implemented EI incentive program also provides a number of advantages:

-expenses on programs pay off due to the rising cost of its shares;

-It does not lead to a dilution of ownership;

-It is an additional way to keeping highly skilled and effective managers.

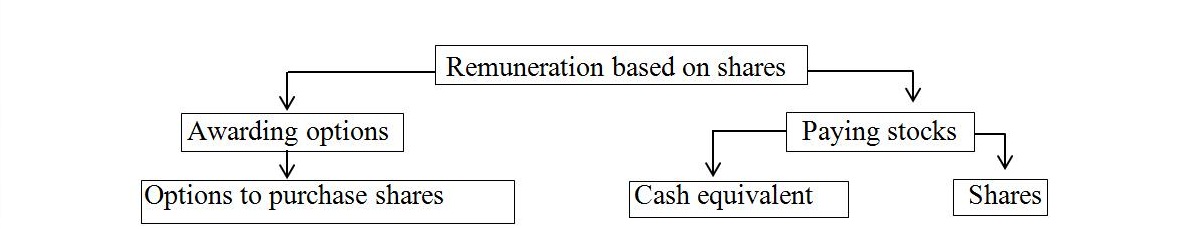

Consider in detail the order of motivation workers by such kinds of EI like stocks and stock options. There are various schemes of incentives based on that used in the international practice (Figure 1).

Figure.1 Motivating workers based on shares in the international practice

Each of these programs has its own features, so it chosen depending on the specificity of activity enterprise, enterprise-level management personnel, planned predictive indicators for the implementation of these programs. There are programs that are limited in performance during a certain period of time, and those that are based on the achievement of certain economic indicators. The conditions and features of individual programs awarding options and stocks are analyzed in more action in the table 1.

Table 1

Characteristics of the main staff incentive programs based on shares

| Types of programs | Characteristic |

| Bonus options | |

| Qualifying option plans |

Member of the Options program has the right to: – Purchase shares at their own expense at a reduced price in the future. – Get preferential tax treatment. Liabilities for income tax arises at the time of sale of shares acquired by option and the tax base is the difference between the purchase cost and the amount of the sale of shares. |

| Savings option program | It is assumed that from the remuneration paid to employees the enterprise can deduct a certain sum. These deductions as are accumulated over a period of time and then they bear some interest. At the end of the accumulation period, the participants can direct savings to buy shares through option exercise or use for other purposes. |

| Bonus shares | |

| Programs providing shares with restrictions | It is anticipated that within two – five participants fully take ownership of shares, with the step mechanism can be used with equal and unequal shares. The participant has no right to sell the shares within two years of acquir full ownership of them |

| Long-term plans motivation | These programs are designed for long term. For example, in the annual bonus a company provides an opportunity for all employees bonuses, top-managers it is necessary to work in the company for more than a year, and ownership of shares are granted ten months after receiving them. |

| Phantom shares | The recipient of phantom shares is not the real owner of the shares for a certain period and receives the cash equivalent value growth stocks and dividends due to recipient. |

In practice, own shares or options on their purchase provide the top-managers in long-term cooperation which is interest to them. In accordance with IFRS 2, [1] such persons can be individual persons are considered employees in terms of the legislation; individual person working for the company under its direction similar to individual persons who are considered employees of the enterprise in terms of the legislation; as well as individual entities that provide services similar to those provided to employees. Thus, the parties to the agreements with payments based on shares can be management personnel executives, consultants, involved lawyers, etc. In the case of concluding an agreement with such persons, in addition to the cash payment, they have the right to purchase the shares of the issuer in the future. In this case, these individuals are interested in value of the shares thus, they are trying to provide high-quality services that will influence the development of the company and growth of indicators of its activity.

Given the fact that in Ukraine the use of this type of stimulation is not very common, there are many issues and problems with displaying such transactions in accounting. In cases when payment of the EI is carried out through of salariees payment or standard bonuses in the form of shares, the display operations are carried out by standard scheme of further reflection in the financial statements. The shares that provided to the employees or bought from the shareholders, and subsequently provided to the top-managars, or issued additionally are reflected in equity accounts, while their nominal value should be set at the level of the stocks that are shareholders. In cases where the EI are given as bonuses to get certain benefits for the company in the future, for example, if bonuses comes as options, the situation is complicated by the fact that they have no nominal value, and the internal cost for the company providing them, does not matter till the moment of the sale of the given option, so remains the question how to reflect these transactions in accounting.

For the purpose of regulation of accounting of payments with equity instruments, IFRS 2, puts forward the following requirements. To account the transactions, the payment of with is made on the basis of the shares using the tools of equity, the entity has to estimate directly received goods or services, as well as the corresponding increase of equity at fair value of the received goods or services, except in cases where the fair value is impossible to estimate accurately. If the entity cannot estimate accurately the fair value of the received goods or services, their value and the corresponding increase in equity capital should be evaluated indirectly, based on the fair value of the equity instruments granted [1].

Determining the fair value of these payments is very difficult, so it is calculated individually in each individual case of the provision of such incentives, arranging with the participant of a particular operation. In such arrangements the number of EI that the employee receives, and the responsibilities which they must fulfill to receive the certain amount of EI are specified. The amount of the remuneration in this case is determined depending on how these securities are traded on the market. With regard to the responsibilities that the worker must fulfill to receive the remuneration, this aspect is closely related to the definition of rights to remuneration. The following rights are conditional and unconditional. Unconditional feight is to light is considered eligible for compensation when services have already been provided by the time of the transaction. Otherwise, when the conditions have to be met on a certain date or after the end of a certain period, the right to compensation is considered to be conditional.

As for the reporting in the accounting operations of management motivation with options, you should note the following. An option is a contract that gives the recipient the right, but does not impose the obligation to buy a basic asset (shares in this case) for a fixed term and according to the previously agreed conditions. For option agreement the pricing, is essential under which the owner of the option has the right to buy the appropriate shares as well as the internal value of the option that is equal to the difference between the fair value of base asset (shares) and the price of exercised option.

If the option has an intrinsic value, then it is called “options in the money” in case the it has no internal value, the option is considered to be the” out of the money “. As for the time value of the option, it is impossible to determine until the intrinsic value of the option, or its absence is defined. The time value of the option is considered to be the part bonus, which remains after subtracting from it the intrinsic value of the option. Consequently, the option based bonuses can consist either of the intrinsic value and the time value, or with only the time value of the option. The peculiarity of the option is that the more time remains to its expiration, the greater is the risk of the growth of the intrinsic value of this tool.

Using stock options it is very difficult when is to determine their value, because of the absence of market prices, as the conditions that are defined for the granbed options are not applied to the options with which the operations on the market are performed. Provided that there are no stock options with similar terms as the options traded in an active market, the fair value of such options will be measured using the option pricing model. In this case, entities choosing a model should consider the factors that will be determined by the knowledgeable, independent stakeholders.

In addition, this formula does not imply the possibilities of changing the other constituents and fluctuations that may occur during the period of the effect of the option. However, for the options that have a short term of turnover the defined above factors may not be taken into account. In this case, Black-Scholes-Merton the model should provide valuation that will not significantly differ from the more flexible option pricing model. All option valuation models usually take into account factors such as: the option exercise price, the term of its force, the current price of the underlying shares, the expected fluctuations in price per share, expected dividends on shares, risk-free interest rate during the option period. Therefore, the market price of EI is taken on discount, if it is known which is very rare for the option, so the option valuation model most commonly used (some of them are listed in the IFRS 2). In cases when it is impossible to set the fair value for the options available, or it is not possible to apply the valuation model, this operation will be estimated by an intrinsic value of the option with the reevaluation of instrument this each reporting date until the operation is closed.

Therefore, if a company provides an option for the motivation of an employee and proposes the conditions, that this option can come into force only after a set period of time and only if this employee the activity in the company will contribute to the improvement of economic indicators, the costs these options will be recognized ratably during this period.

Conclusions. Thus, international experience, proves to have plenty of programs to motivate employees on the basis of shares that have been successfully operating. The most common are programs with bonus options and bonus shares. Incentive programs are developed by each enterprise individually, depending on the purpose of the implementation of such a program. Often, the purpose of such programs is to motivate employees to work on this enterprise and enhance the performance of the company. The experience of such program in Ukraine also exists, but they not are always, reflected in the accounting. An accounting of the cost of programs to motivate employees has to be kept proportionately within the whole period of the program until its completion. The specific feature of operations in stimulation of workers by means of the equity instruments is the complexity of their recognition and valuation if these payments are not made in form wages or standard bonuses.

References

1. Platish na osnovi aktsii. Mizhnarodnyi standart finansovoi zvitnosti № 2 vid 30.12.2008r. – [Elektronnyi resurs]. – Rezhym dostupu: http://zakon5. rada.gov.ua/ laws/show /929_005.

2. Pro zatverdzhennia polozhennia (standartu) bukhhalterskoho obliku 34 «Platizh na osnovi aktsii»: Nakaz MFU vid 30.12.2008r. № 1577 (Redaktsiia vid 10.01.2012) – [Elektronnyi resurs]. – Rezhym dostupu: http://zakon5.rada.gov.ua/laws/show/z0057-09

3. Lohynov A. A. Sovremennoe korporatyvnoe upravlenye – motyvatsyia sotrudnykov na osnove aktsyi[Эlektronnыi resurs] / A. A. Lohynov // Aktsyonernoe obshchestvo: voprosы korporatyvnohoupravlenyia. – 2007. – № 9. – Rezhym dostupu: http://gaap.ru/articles/50587/.

4. Bratsylo A. Raschetы dolevыmy ynstrumentamy [Эlektronnыi resurs] / A. Bratsylo // MSFO:praktyka y prymenenyia. – Rezhym dostupu: http://www.ippnou.ru/print/005599/.

5. Sapronova O. S. Forvardnыe kontraktы y optsyonы na sobstvennыe aktsyy – uchet po MSFO yRSBU [Эlektronnыi resurs] / O. S. Sapronova // Korporatyvnaia fynansovaia otchetnost.Mezhdunarodnыe standartы. – № 10. – 2011. – Rezhym dostupu: http://gaap.ru/articles/Forvardnye kontrakty-i-opciony-na-sobstvennye-akcii/.

6. Hrachova R. Rozrakhunky za uchastiu instrumentiv vlasnoho kapitalu [Elekronnyi resurs] / R. Hrachova // Dt-Kt. – 2008. – № 06. – Rezhym dostupu: http://dtkt.com.ua/show/1cid03469.html.

7. Hrachova R. Optsiony i varanty: bukhhalterskyi oblik [Elekronnyi resurs] / R. Hrachova // Dt-Kt. – 2004. – № 07 – Rezhym dostupu: http://dtkt.com.ua/show/1cid0733.html.